ThinkOrSwim Coder

Are you looking for a Thinkscript coder? You have visited the correct place. My Team (headed by T.Todua) do programming and coding of Indicators and Strategies for ThinkScript, which contains different types of scripts (for Charts, Custom Column – Scans, Alerts and etc..). So, if you need a Thinkorswim programmer, then you contact us. Please, don’t forget to send all details related to your task, better to be written in a Text document. Terms are negotiable. Each task will be individually reviewed, and you will be given the final quote.

[[include-page id=”385″]

CAN YOU REVERSE ENGINEERE THE ZIG ZAG HIGH LOW INDICATOR IN THE THINK OR SWIM PLATFORM?

Hello.

If any indicator’s source in TOS (i.e. ZigZag) is protected and not viewable in TOS editor, the I cant’ reverse-engineer.

I can find & build something like that, but not exactly 100% that (if i cant find out the exact logic).

Take a look at either Basic Market Structure or AutoWave indicators on this website: https://rrpayne.blogspot.com/p/fun-with-thinkscript.html

Hello wanted a yearly volume profile value area.

Presently thinkorswim allows me to display on balance volume indicator. I would like to display the OBV and a exponential moving average overlaid over it. Can you tell me the fee for your work?

Thanks

Anthony Vallone

I’ve mailed you.

Hi,

I would like you to develop custom scanner for TOS platform using certain criteria on my ‘modified chart’ (which I can show you when you are ready)

Example (this should be customizable parameters)

Show stocks where closing price is above 25

and Stochastic on ‘daily’ chart at 20 and crossing above

and ‘modified MACD’ on ‘3-day’ chart is starting angling up (from down position.

I can show you more detail on my modified TOS platform using TeamViewer.

If this can be done, please give me quote first.

Thanks.

hi can i get thinkorswim scripts for TRADE THE RANGE set up and impulse pullback 6ema cross 18ema . thanks for you help

About ThinkOrSwim

(TD Ameritrade – Online Stock Trading, Investing, Online Broker)

Thinkorswim® is an innovative trading platform, which offers different opportunities to traders.

=== A short brief ===

Thinkorswim – a modern and adaptive platform. Brings you the new trading experience, offered by TDAmeritrade) . It helps you to be on the top of the market, with many essential tools and resources, as you are will be able to trade from your desktop, with an user-friendly interface and easy navigation panel. Modern look & feel, adjusted for customers. It can send notifications to your mobile phone, it supports many chat rooms, where you can have a chat with other traders and support center. You can read their magazine, which gives traders some tips and advises. It is easy to open account with TD Ameritrade, which also offers you some cashbacks while opening the account. With TOS, traders keep connected to trading world.

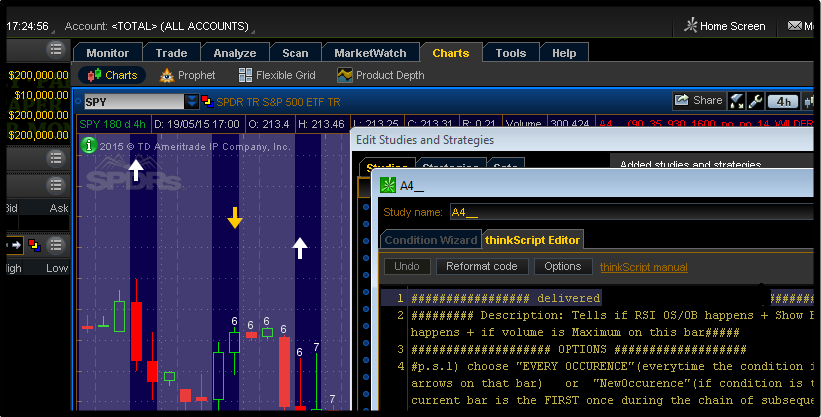

About ThinkScript programming

ThinkScript is a coding language of TOS, so ThinkScript Editor Window gives us ability to create, test and modify the scripts (indicators, strategies, custom-columns, alerts, scans …). There is also an integrated help-sidebar, which gives you definition of functions and reversed words. TOS offers you a wide range of built-in indicators and strategies, so you can test them easily. In case you need to customize or build a new script, you can also order a custom-coding service, like us.

I need a existing TOS indicator ( Stochastic Momentum Index ) modified to :

1. Generate a alarm at every cross-over. Alarm to be both visual ( flashing screen. Manual turn off.) and audio ( beeping for XX time )

2. If there is a trade attached then EXIT the trade.

Awaiting your reply.

Looking simply for a couple of spread indicators on TOS.

1. Divide IV% by HV%.

2. Divide IV by IV%.

Two simple divisions.

I’m looking to have a break out strategy with a scanner against all e-mini and micro futures on CME

Long entry rules= breakout 20 day channel

Scale/add into trade when price bounces off of 20 SMA

Close = close when price closes below the 20 sma or 5% off account balance

Short entry rules= breakout 20 day channel to the down side

Scale/ add into short trade when price bounces off of 20 SMA

Close= close when price closes above the 20 sma to the upside

Can you write rick management rules in to think script? I want to risk no more than 5% per trade when breakout occurs.

I want to create a Indicator which works on slope of Moving average in Combination of Renko or Tick charts. for eg the slope of 2500 tick chart 10 period SMA is rising go bullish and vice versa. Same for Renlo with different tick ranges.

Let me know if you can program this.

I would like to be able to have a watchlist that compares the current price per minute to a variable named RXT. The RXT values change daily, so, I would need to be able to input the values for each symbol in the watchlist. For instance (and this is not proper code) the script would have a list of symbols as def of is symbol with a value for RXT. ie.

Appl 117.51;

AMZN 3217.01;

CSCO 39.20;

The watch list would compare the current price to the RXT value for that symbol, if the current price were equal to or greater than RXT, an alert would sound, and display that the symbol is equal to or greater than RXT.

Since this would be for probably a list of symbols exceeding 100, I would like to be able to edit the RXT value in one variable list.

Is this something that can be done?

I want to write a script to include technical and fundamental indicators. Please advise if you can help with this.

I wanted to see if you have a scan program (not chart) to look for reversal in price, volume, RSI, macD, that would show an opportunity to buy and an opportunity to sell.

Can you use real time data in thinkorswim to set up a trading model with certain rules for adjusting trades?

I wish to create a simple study that draws a static horizontal plotline exactly 4% below the close of the previous candle. To be used as a visual stop-loss reference for jumping in and out of trades.

This study would be used primarily on a 1,2, 3, or 5 minute chart on mostly penny stocks.

Can you help?

I need to discuss a strategy that I would like you to code

Hi, I have a study script that i would like someone to develop a scan when it hits certain criteria.

I have a strategy for which I need some automation. Would like to discuss